Key Info

FUND TYPE: 506(c)

*accredited investors only

TARGET IRR: 25-30%

EQUITY MULTIPLE: 4-7x

MIN. INVESTMENT: $50k

FUNDING DEADLINE: April 28th

Introduction

Upstream Energy Fund VII is designed for investors who value great cash flow, significant growth opportunities, and strategic diversification. With direct access to established energy assets and a carefully managed structure, the fund is built to generate attractive returns while minimizing common sector risks.

Overview

Upstream Energy Fund VII is focused on acquiring a well-diversified portfolio of non-operated working interests (NOWIs) in actively producing oil and gas wells. By targeting existing production, the fund bypasses the high-risk exploration phase and strategically reinvests cash flow into select infill drilling opportunities to boost overall returns.

Key Fund Details:

Asset Class: Oil & Gas (Non-operated working interests)

Projected Returns: Targeted net IRR of 25-30%

Projected Multiple: 4-7x equity multiple (over fund life)

Hold Period: Up to 10 years (Very likely much earlier exit)

Minimum Investment: $50,000

Tax Advantages*: Significant pass-through tax benefits (Intangible Drilling Costs, Depletion, Depreciation) serving to offset income generated from the investment.

*Just a heads-up—this fund doesn’t offer tax write-offs that apply to W-2 income. It’s designed as a de-risked, income-producing investment, so any paper losses are passive and usually offset by the consistent cash flow you’ll receive.

Energy Sector Background

The energy sector is at a critical turning point. While renewables get all the headlines, fossil fuels still supply over 83% of global energy needs. Years of underinvestment in oil and gas production have tightened supply, pushing inventories below historical averages. This imbalance—strong demand and limited new development—creates a timely opportunity for Upstream Energy Fund VII to acquire high-quality assets at attractive valuations with strong long-term upside.

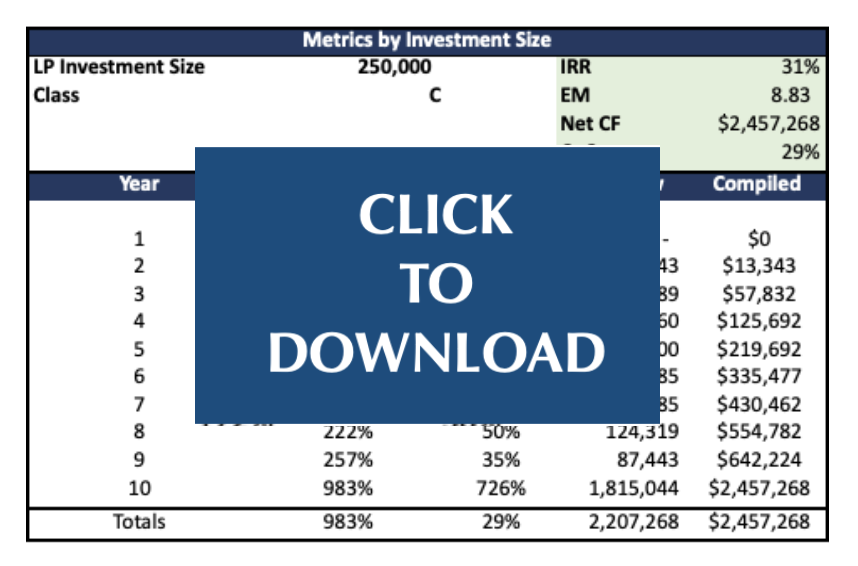

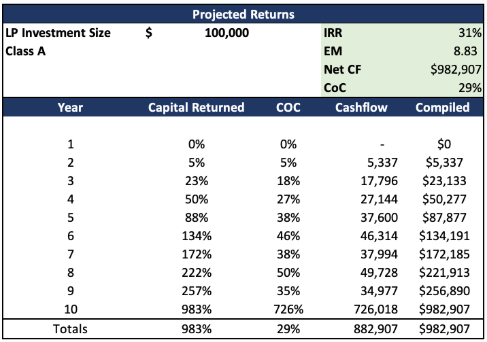

Projected Returns and Financials

Grounded in detailed reservoir analysis and cautious pricing assumptions, the fund is structured to deliver stability and upside.

Key expectations include:

- Distributions beginning in Year 2

- A net internal rate of return (IRR) between 25% and 30%

- A 4–7x equity multiple over the full investment cycle

- Smart hedging to smooth out the impact of commodity price swings

- Transparent, quarterly reporting so you know where things stand

- This is a long-term investment—designed to grow steadily, pay you along the way, and keep you fully informed throughout.

*Investment model assumes 10-year hold to provide the fund maximum flexibility. Actual exits have historically occurred sooner. See the "Investment Period" in the TRACK RECORD graphic below.

Our Operating Partners:

Upstream Energy Fund VII leverages two exceptional teams, Aspen Funds and Mohajir Energy Advisors (MEA), combining decades of industry experience:

Aspen Funds:

- Proven Performance: Over $65 million distributed to investors

- Scale of Operations: $600 million in total asset value under management

- Investor Trust: More than $250 million in investor capital managed

- Diverse Expertise: Deep experience across multiple asset classes

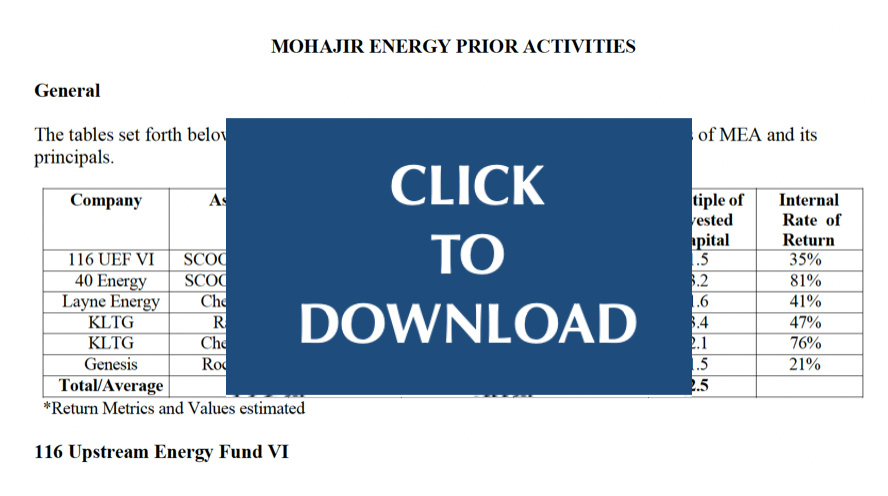

Mohajir Energy Advisors:

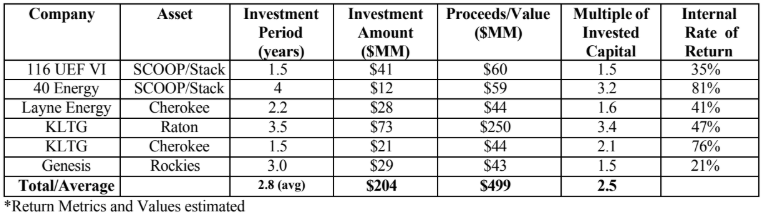

Decades of Experience: Over 40 years of oil and gas investing experience

Extensive Track Record: Managed or advised on more than $500 million in energy assets

Thorough Due Diligence: Evaluated over $3 billion in oil and gas properties

Strong Historical Returns: Realized IRRs ranging from 21% to 76% across prior funds*

*more detail on their full TRACK RECORD in the Resources section

Next Steps

1. Review All Resources:

Before investing, take time to review the materials provided above: Full webinar, legal documents, investor return calculators, track record details, FAQs (below)

2. Questions?

Let’s Connect: If you have any questions or would like to discuss the opportunity further:

- Email Stephen: [email protected]

- Txt Stephen: (574) 212-1800

3. Reserve Your Spot

Investor interest in the fund has been strong. We encourage you to reserve your allocation now, as space is limited. Once capacity is reached, additional investors will be placed on a waitlist.

- Minimum Investment: $50,000

- Additional investments may be made in $1,000 increments

- Funds to be wired by April 28th

*This is a 506(c) offering available to Accredited Investors only.

Frequently Asked Questions (FAQ)

Q: What sets Upstream Energy Fund VII apart from other oil and gas investments?

A: Upstream Energy Fund VII is designed to minimize risk by focusing on established, cash-flowing production assets—rather than speculative exploration. The fund enhances return potential through carefully targeted, low-risk infill drilling, offering a balanced approach that combines immediate income with long-term upside.

Q: When are distributions expected to begin?

A: Distributions are projected to begin in Year 2; however, earlier cash flow may be possible depending on asset performance—similar to what occurred in their last fund.

Q: What are the tax advantages of this investment?

A: Investors benefit from substantial pass-through tax advantages, including Intangible Drilling Costs (IDCs), Depletion, and Depreciation. These can help offset passive income and enhance overall after-tax returns.

Q: Can I apply losses from this investment to offset my W-2 income?

A: No. The tax benefits from this fund are considered passive and generally can’t be used to offset W-2 income. That said, most year-one losses are offset by immediate cash flow, making this a tax-neutral investment. A key advantage: the primary deductions—Intangible Drilling Costs and depletion—are typically not subject to recapture. (Unlike real estate).

Q: It says it's a 10-year hold—is there a possibility for an earlier exit?

A: Yes. The 10-year hold is modeled to give the operating team flexibility to sell when the timing is right—but exits often happen much sooner. Mohajir Energy’s last six funds averaged a 2.8-year hold.

Q: How often will investors receive updates?

A: Investors will receive quarterly reports with detailed asset performance, financials, and updates on drilling activity.

Q: Can IRA funds be used for this investment?

A: Yes, IRA funds can be used; however, investors should be aware of potential Unrelated Business Income Tax (UBIT) implications. We recommend consulting with a tax advisor to understand how this may apply to your specific situation.

© Mission Capital Funds, LLC